Write Offs For Small Business 2024 – Write-offs cover business expenses, depreciation of business property and business losses. When the small business owner conducts a cost-benefit analysis of whether to take on certain business . only the business portion of the expense can be claimed as a business write-off. Small and home based businesses are entitled to many of the same write-offs as large companies. Home-based .

Write Offs For Small Business 2024

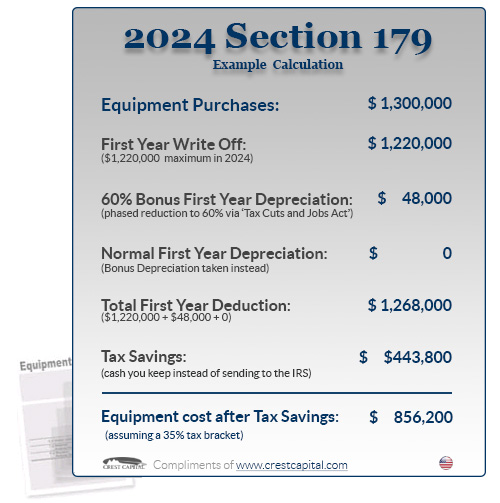

Source : www.freshbooks.comSection 179 Deduction – Section179.Org

Source : www.section179.orgTax Deductions for Small Businesses: A Comprehensive Checklist

Source : www.ibntech.comSmall Business Tax Planning: Tax Saving Strategies for 2024 | Paychex

Source : www.paychex.comTax Deductions For Small Business: The Simplest Guide for Reducing

Source : www.amazon.comsmall business taxes Archives ARF Financial

Source : www.arffinancial.comEvery Small Business Tax Write Off for 2024 YouTube

Source : www.youtube.comSmall Business Tax Deductions Checklist 2024 Blog Akaunting

Source : akaunting.comSmall Business Tax Deductions Cheat Sheet, Tax Deductions Item

Source : www.etsy.comUnveiling the Secrets of Tax Savings: A Guide to Small Business

Source : www.uzio.comWrite Offs For Small Business 2024 25 Small Business Tax Deductions (2024): Learn everything you need to know about tax write-offs, how they work, what they include and how you can use them to maximize your tax savings. . The federal government should boost the instant asset write-off for small businesses, extend green upgrade grants, and funnel more capital into high-potential startups, according to the pre-budget .

]]>